START TRADING 101 | Lesson 4

Selecting Stocks the Right Way. How Important do You Think it is?

Some lessons in life need to be learned the hard way to stick.

Maybe you know the saying: children only realize that the stove is hot once they touch it and get burnt – no parental guidance could be as effective as making that painful experience.

It’s the same with picking stocks. And I learned my lesson the hard way, and not only once! Here is what happened in one of those life lessons:

How I lost 3 times more money than ever anticipated, and why

Several of years ago, a friend of mine and I chatted about, you guessed it… stock trading.

I had been trading already for 2 years at the time and I felt confident with the trading style I had developed. He himself had been trading some years earlier but had stopped for a while.

He was excited about a “hot stock” that paid great dividends and was about to jump up after the next earnings report.

How had he heard about it? A friend of a friend was working at the company and had told him they were doing better than the rest of the industry.

So, what did I do next?

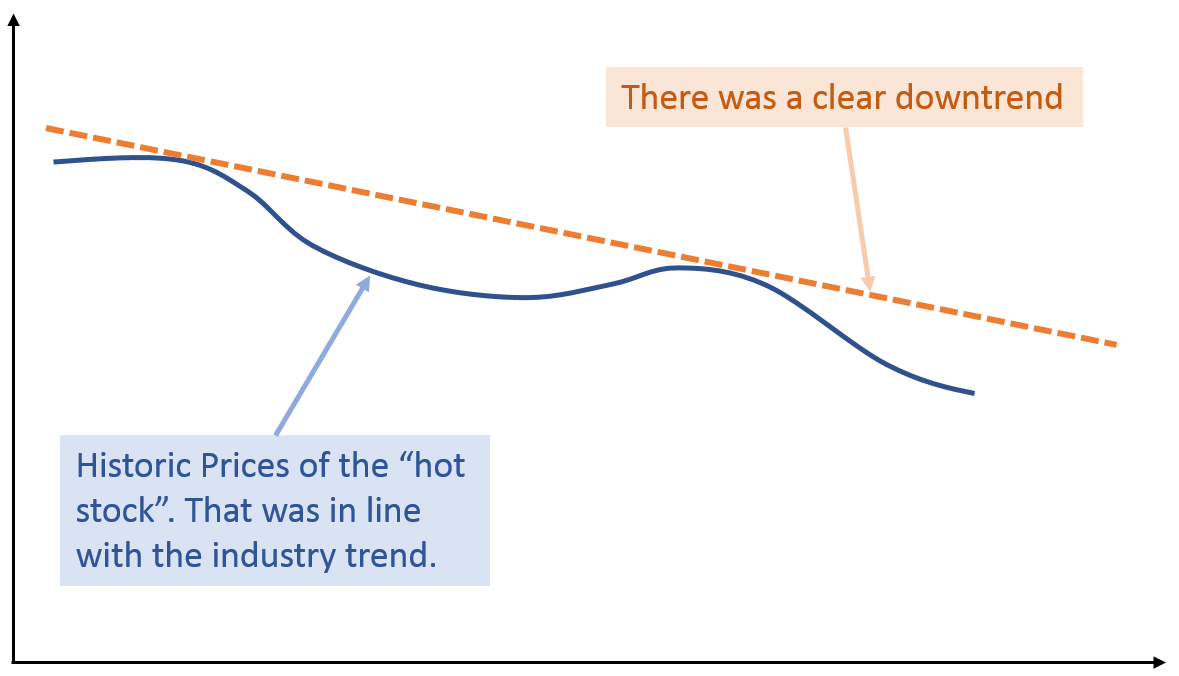

I looked up the chart and I noticed a downtrend. The company’s market sector was in a crisis, so that came as no surprise – but the dividend rate was great (above 5%, try to find that for a savings account!) and if indeed they did better than the rest of the industry…

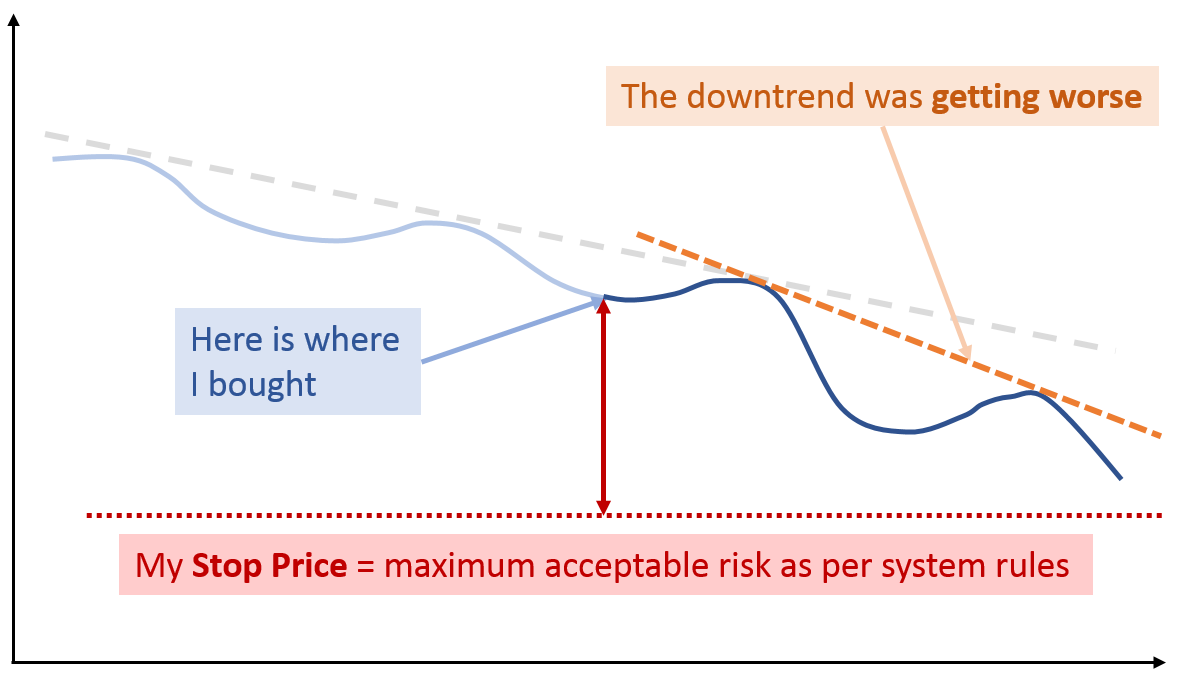

I bought a sizable amount of stocks from this company – and, I put my stop price.

Better safe than sorry, right? And as usual, I would bail out if the stock price was sliding too much.

2-3 weeks later… the stock price had accelerated its downtrend and was already close to my stop price.

In other words, my trade was “under water”. A big fat minus in my portfolio. And the quarterly earnings report was still 2 weeks out… and the dividend payment was 4 weeks out… what to do?

Here is how things unfolded afterwards:

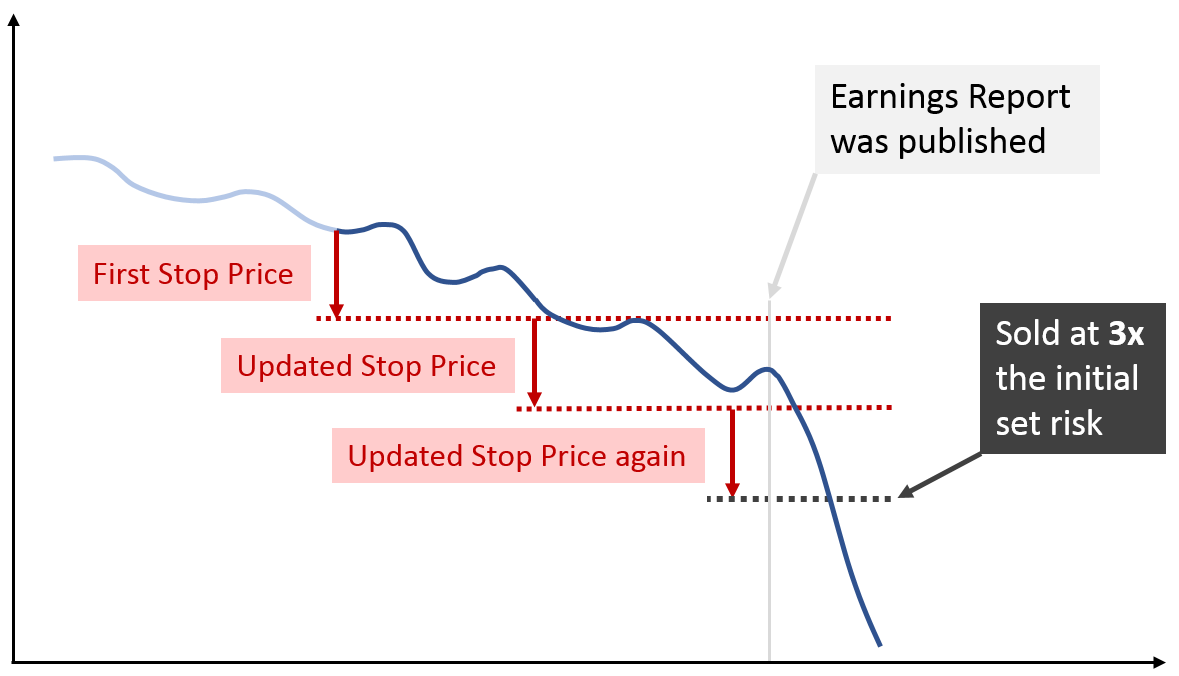

- I lowered my stop price – I did not want to be thrown out of the trade and I wanted that earnings report to come to “save the trade”. And getting that dividend payment would be a nice bonus on top of it!

- The price went down further, and further. It approached my new stop price. A few days left until the earnings report would be published!

- I moved the stop price further down.

- The earnings report was published. It was a disaster! Not only was the company’s situation as bad as the rest of the industry (or even worse), but they also decided to stop dividend payments. The price tumbled immediately and I sold at a massive loss.

Did I mention that the “amazing” dividend payment would have been less than 1/5 of my initial risk?

So, in the end I took a loss that was 15 times higher than the potential dividend payment I was hunting after for weeks! That’s a really bad reward-to-risk ratio.

This trade was terrible. Not only because I lost 3 times the amount I had set as my initial “bail-out risk”, but also because it was entirely my fault. Ouch!

Not only should I have known better at the time… I actually DID know better than doing what I did.

And yet… I messed it up.

My friend is not to blame – as traders, all our trades are our own responsibility. If you think the blaming game works for you when trading… good luck with that 🙂

What went wrong here?

There were multiple issues, but it boils down to one major problem: I broke the rules of my trading system!

- I trusted a single source of very vague information

- I disregarded all other information (industry trends, market sector downtrend etc.)

- I bought a stock that was not on my shortlist

- I bought a stock that did not show any buy signals (in fact, it was screaming “sell now!”)

- I ignored my risk management rules

There were three positive things though…

1) I did not blame my friend but myself,

2) while it was a bad loss, my portfolio survived to trade another day and

3) this lesson stuck and it never happened to me again.

For picking stocks, use a system with an edge

What I want to drive home here is that using your trading system rules for stock picking is the way to go.

If I had not ignored my own trading rules for stock selecting, problems 1-4 would not have happened. The trade would not have been executed and I would not have had that big losing trade in my books.

And had I not ignored my system further (by breaking my risk setting rules), it would have been a manageable loss instead of a massive loss.

Risk management comes in a later lesson; for now, we will focus on how to select stocks with an edge.

What’s an edge in trading? Here’s a definition:

A trading edge is a technique, observation or approach that creates a cash advantage over other market players. It doesn’t have to be elaborate to fulfill its purpose; anything that adds a few points to the winning side of an equation builds an edge that lasts a lifetime.

In a nutshell, it’s a way to select stocks that has a slight advantage over random guessing (in the long run).

There are many ways to achieve this – in this lesson, I will teach you 2 techniques that have a proven, decades long track record.

But first, let’s see what the problems are with stock picking.

Common issues with selecting what to buy or sell

Stock picking is usually the most talked about topic during a discussion about trading.

It’s always a hot topic, and people just love to talk about it. Here are the issues that cause the biggest performance problems (related to stock picking):

1. It’s thought to be the most important thing to “get right” when trading

2. People are inconsistent when choosing stocks and they have no edge

3. Information overload

4. Giving up too fast

Let’s look at each in more detail.

The most important thing (in trading)

I mentioned it before and I keep saying it. Stock picking is thought to be the most important part of trading. But it’s not.

Risk management is.

I know what you are thinking: this “disaster trade” talked about earlier would not have happened if I had not ignored my stock selecting rules.

So how can it not be the most important thing? Risk management would have mitigated the loss… while “right” stock selection would have avoided the loss altogether.

I get it, and you have a good point. And you would be correct if “right” stock selection would mean being right 100% of the time.

But that’s impossible.

Losses are inevitable in trading, and selecting the right stock is not only about how often you are choosing a winner, but how big the winner is going to be.

Remember Lesson 1 where we talked about expectancy?

As long as your expectancy is above zero, you have a system with an edge.

There are trading systems with a positive expectancy that choose the “right” stock only 30% of the time… but the winners give huge profits.

So, losses will happen all the time, and you need to protect your portfolio from them by minimizing them. This is what risk management rules will do for you. It’s like losing battles but winning the war.

Inconsistent stock picking

There are many reasons for being inconsistent when selecting stocks, but here are the two primary ones:

- Listening to unsolicited advice

- Choosing based on emotions

We are used to giving and getting advice.

Everybody has their own specialization and expertise, and we love to share it with others. And if we need advice from an expert from another field then we can easily get it.

Pseudo-Experts

Everybody seems to be an expert in investing money, and everybody has their own opinion. It’s hard to distinguish between real experts and pseudo-experts.

When visiting a doctor, we can be reasonably sure that we really see an expert – with financial advice that is more difficult.

Random-like nature of the field

The stock market is complex and its behavior often appears like random.

That makes it extremely difficult, if not impossible to forecast the future. It’s a bit like the weather forecast. It might be reasonable to make a prediction for a few days into the future – but everything that comes afterwards… who knows!

Engineers don’t have such problems. They can forecast how much of a beating their designed products can take.

It’s in the non-random realm, so there is an algorithm or empirical wisdom for that. But the stock market is not that type of place, and randomness plays a much larger role than we like to think.

No skin in the game

Remember my friend who gave me his advice on which stock to buy?

Well, he loved giving advice. But he did not buy any of that stock. That should make you stop and think! It is easy to give advice without taking any risk – after all, nothing will happen if the advice was wrong.

That being said – it does not mean that experts are more often right if they invest themselves (with few exceptions, like Warren Buffet, and even he is wrong sometimes).

But I tend to listen more to them if I know they are at risk. Experts who just talk (think of CNBC!) but don’t have a stake in what they advice are off my radar.

Emotional trading

We already discussed the effects of emotions on trading in Lesson 2, so I will not repeat it here.

Just be aware of it… emotions are what they are, and there should be no connection between them and your decision making.

There is just too much information out there

Listening to a single vague source was an example of not enough information, or ignoring additional information.

But today the problem is often reversed – there is so much information that we cannot consider all of it.

We tend to spend a lot of time gathering information, thinking that it will help us deciding. But more and more information is only noise, and it is more confusing than helping.

It’s easy to get stuck in analysis mode and do not make any decision.

When does it “stop working”?

Every trading system has an “optimal” working environment.

A trend following system is not working well if there are no trends. A string of bad trades can make us think that the system stopped working, and we abandon it, to jump on another one.

And often we switch too soon.

It’s difficult to decide when you need to adjust, but it’s important to give your trades some time to unfold their potential. Sometimes for many months there might not be a lot of good trades; but then suddenly your system does great.

Giving up too fast and switching to another system can be expensive and discouraging.

So, what’s the solution?

I think you guessed it already. Build your own stock selection system and let it do the heavy lifting for you.

By doing so, most of the above problems will not occur or can be significantly reduced. Here’s what it will do for you:

- It lets you be consistent in selecting stocks

- It lets you ignore noise, emotions and unsolicited advice

- It has an edge

- It’s measurable and can be adjusted over time

It does not mean delegating decision making!

You will still need to decide what to buy or sell. But your system will provide you with the best possible options to do so.

Now I will show you two stock picking systems that have withstood the test of time: The Breakout system and the X-Over system.

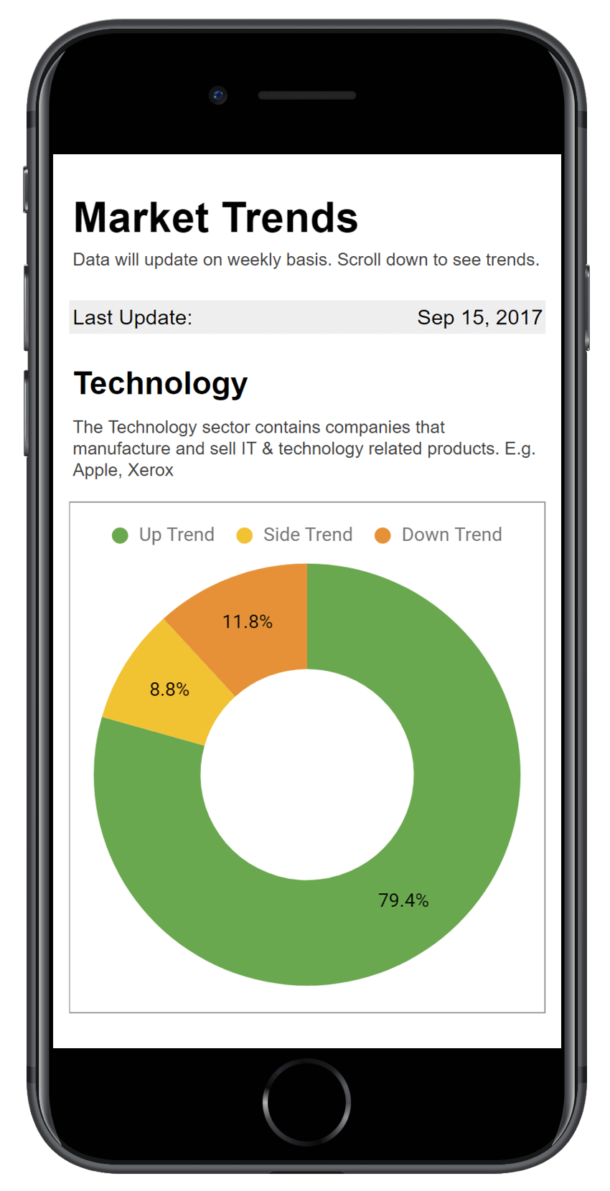

Stock selection systems that detect trends

Remember that we talked about different trading types?

Depending on what trading type you choose you will need a matching stock selection system. Here I will discuss about stock selection systems for trend following strategies; their job is to highlight candidates in your shortlist time slice that might develop into new trends.

The Breakout System

This system is one of the simplest systems to select stocks.

If you think that you need fancy calculations to detect potential trends, think again! The only thing you need for this system is a line chart of the stock price with at least 1 year of historic data.

Here is how it works:

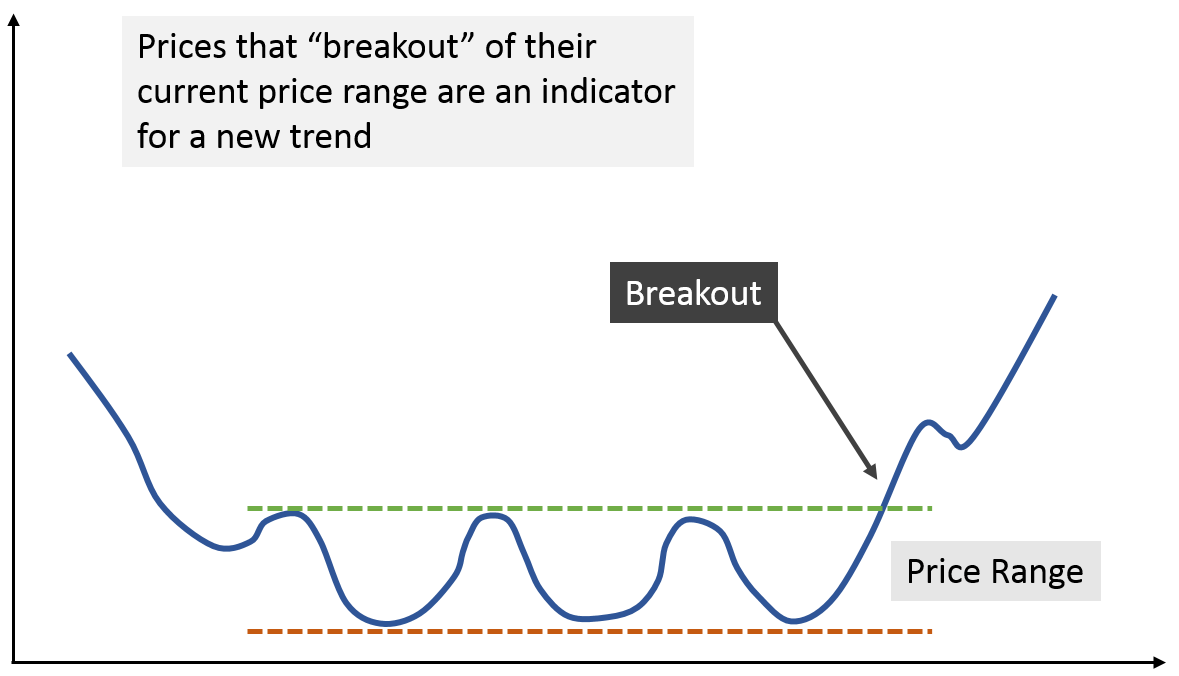

Prices tend to move within a certain price range with no real trend emerging. If the price moves outside of the common price range, then a new trend might be starting.

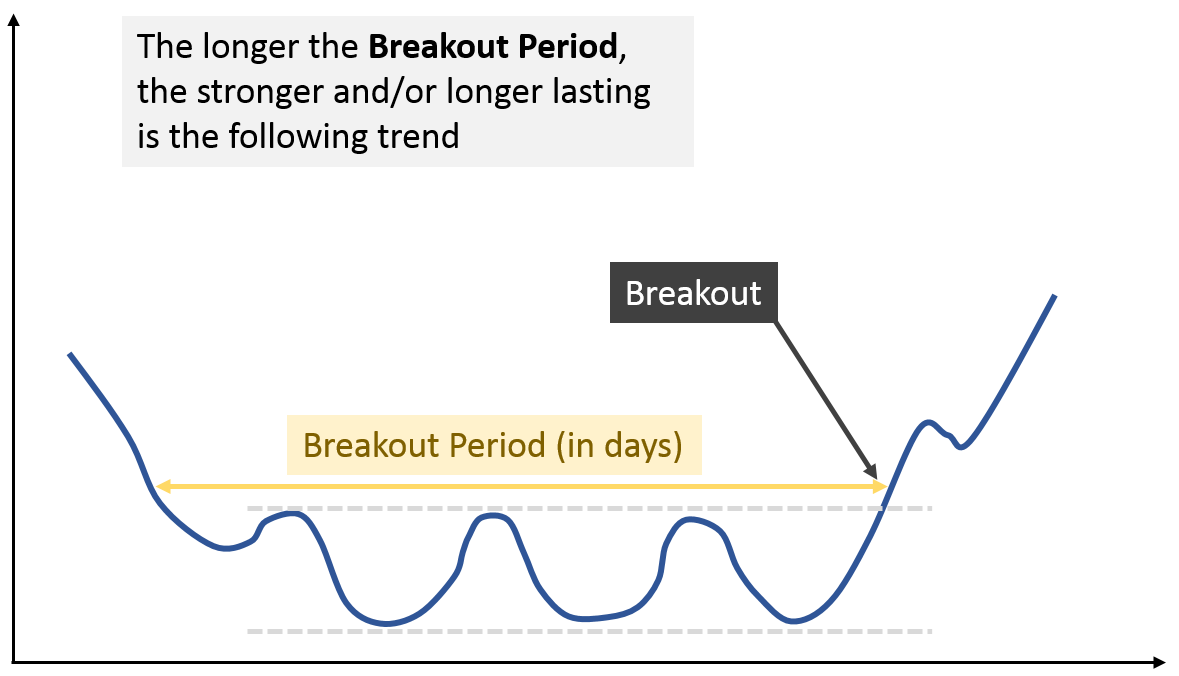

The above line chart shows the principle.

After an initial downtrend, prices moved for a while within a range. Then they moved outside of the upper range.

That’s the cue!

Prices were bouncing back and forth because investors were at balance between optimistic and pessimistic. Until the breakout… once it was proven that higher prices are possible, many traders changed their mind and bought… driving prices higher and creating a new uptrend.

The breakout period is an indicator of the trend that could follow.

The breakout period is simply the number of days between the current price and the last time prices were at that same value.

The longer the breakout period, the stronger and/or longer the potential trend.

You can calculate breakout periods for any “new high” price –they can be quite short, too. But short breakouts might be not very significant and the trend might stop sooner rather than later.

I look for breakout periods of 60 days or more – but that’s just a suggestion. Trading with shorter periods can also work.

Let’s look at a real example:

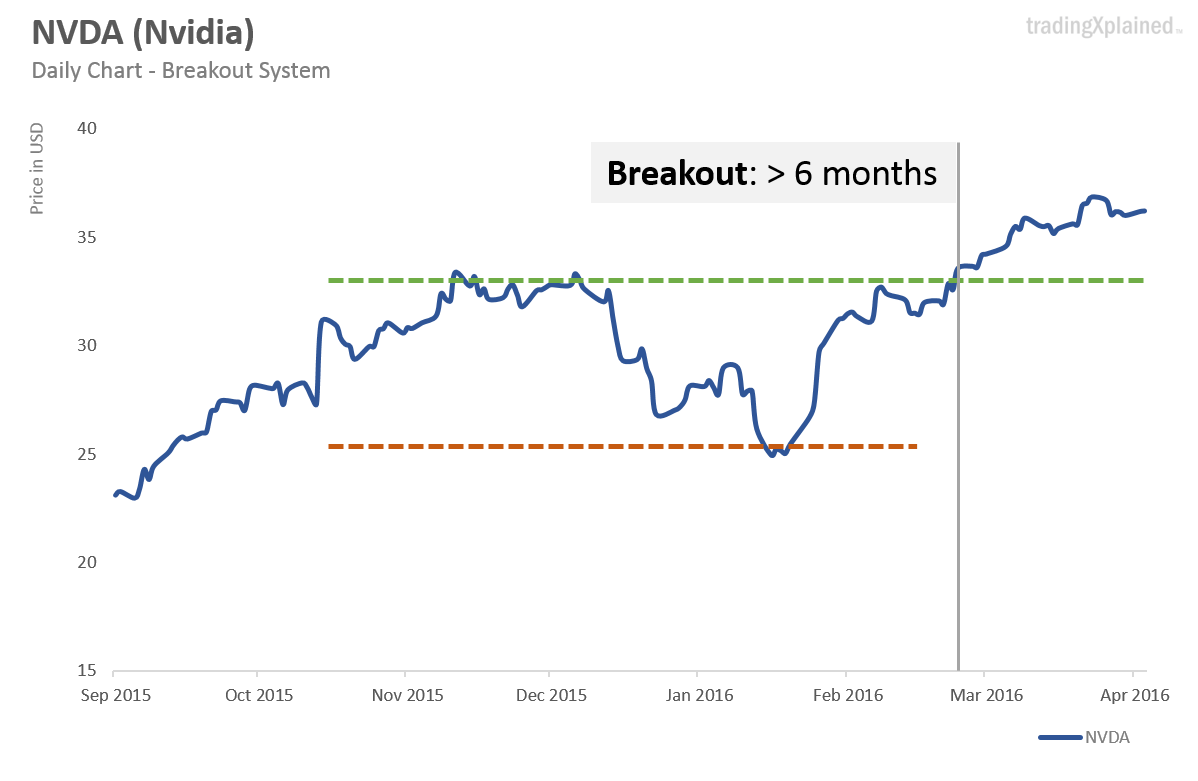

The above chart shows NVDA stocks.

There had been an earlier uptrend already, and then a retracement of the price to $26. Afterwards, the price moved up again, breaking out of its range to new highs.

The breakout period is longer than 6 months, which is significant.

A few days after you detected the breakout, you might decide to buy this stock at approx. $35.

Then wait and see if the trend continues. You should have protected your investment with a stop price (we will discuss that in another lesson in detail).

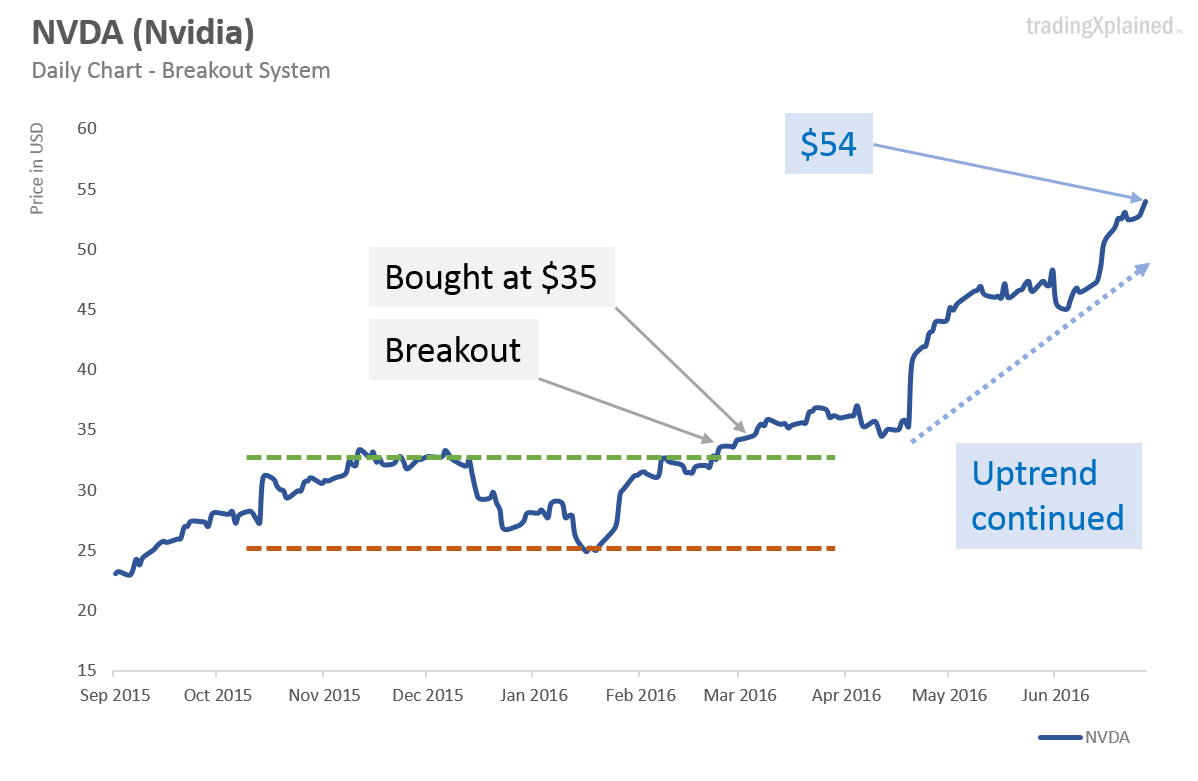

It’s 5 months later and the trend developed nicely, reaching new highs regularly.

It’s now at $54 – a gain of 54%… that’s fantastic! It’s a big winner.

Should you sell now and cash in your well-earned money? If you remember Lesson 1… nope. You should let profits run.

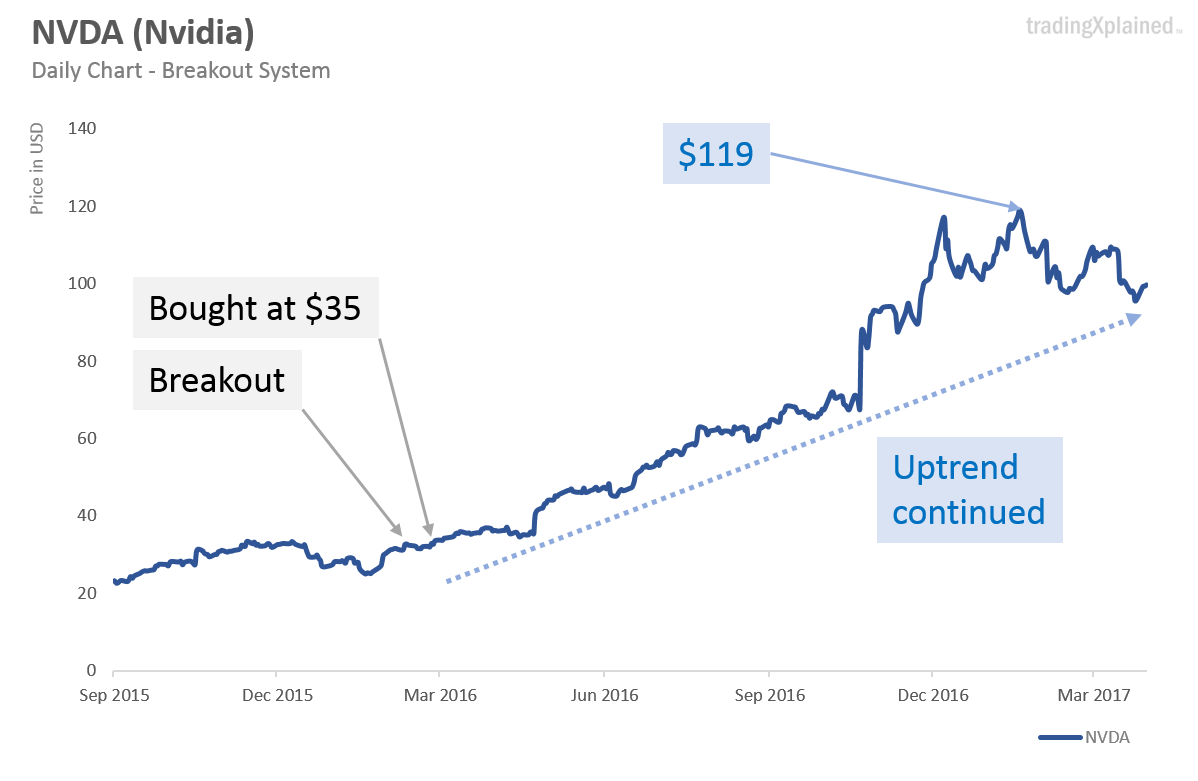

And… the trend did continue.

Its highest value (within the data range) was at $119. That’s a gain of 240%! Just imagine what you would have missed out on if you would have sold at $54.

So, that’s really all there is to the breakout stock selection system.

In summary:

- Review each chart that is within your time slice list

- Check for significant breakouts – it can help to draw a horizontal line from the new peak price back to the last time such prices were seen to determine its breakout period

- If you have more than one candidate, compare their breakout periods and trends

- Make your decision which one to buy. I do not recommend to buy more than one at a time (because of risk management – discussed later in Lesson 6!)

Now let’s have a look at the second selection system: The X-Over.

The X-Over System

The X-Over (short for cross-over) system uses additional chart lines to create a buy signal.

These additional chart lines are called “indicators”. There are thousands of different indicators available today – this system uses a very simple one, the Simple Moving Average (SMA for short).

An SMA curve is created by averaging the stock price over a specific period of time. The number of days that it is averaged will be attached to its name.

For example:

SMA-20 = Simple Moving Average over 20 trading days.

To create the SMA-20, calculate the average of the current share price and the previous 19 days. That’s today’s SMA-20 value.

Yesterday’s SMA-20 value would be the average of yesterday’s share price and the previous 19 days.

It’s easy to calculate in a spreadsheet (we will go through this in the worksheet) – but any chart website has this included in their indicator section. Below is an example (animated GIF):

The SMA is a lagging indicator; that means, it follows the share price curve with a delay (of which it was constructed from). The longer the SMA period is, the more it lags, and the smoother it is.

When the share price makes a strong move, the SMA curve often cannot keep up and overshoots – the longer the SMA period, the more it overshoots.

This leads to SMA curves to cross over each other. That’s what is used as a signal for our stock selection.

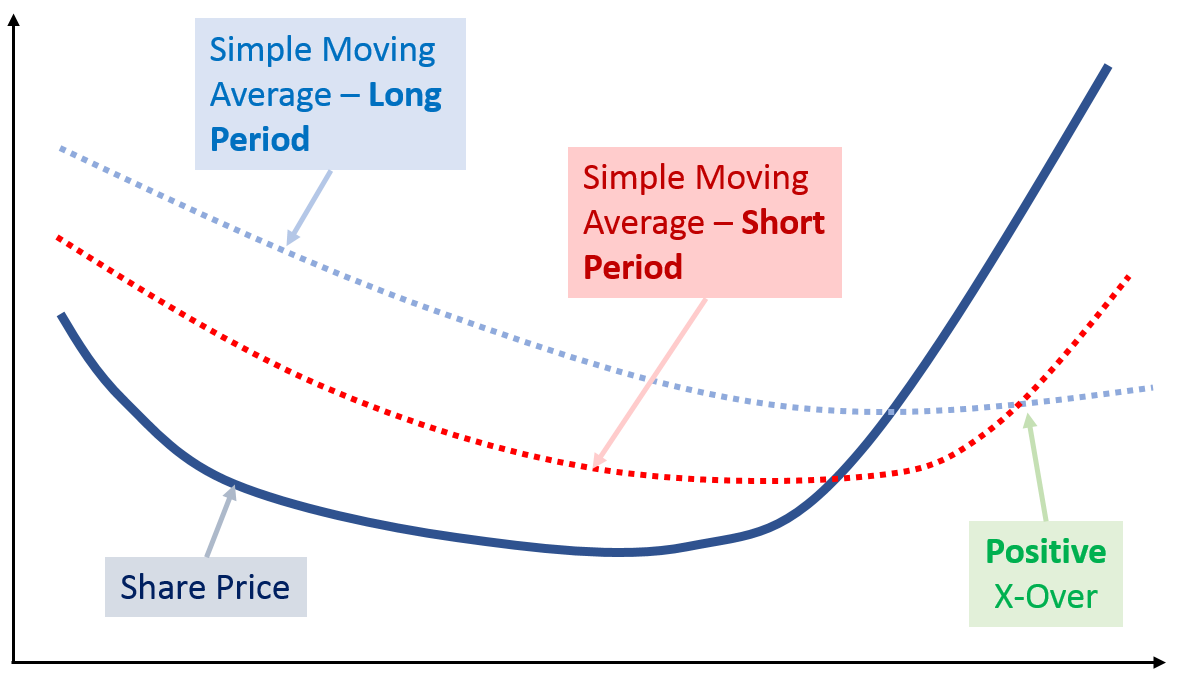

The image above shows how a positive x-over signal looks like.

The share price changes into an uptrend; the SMA curves follow, but much slower. The short period SMA curve crosses over the long period SMA curve, overtaking it, indicating that a new uptrend might have started.

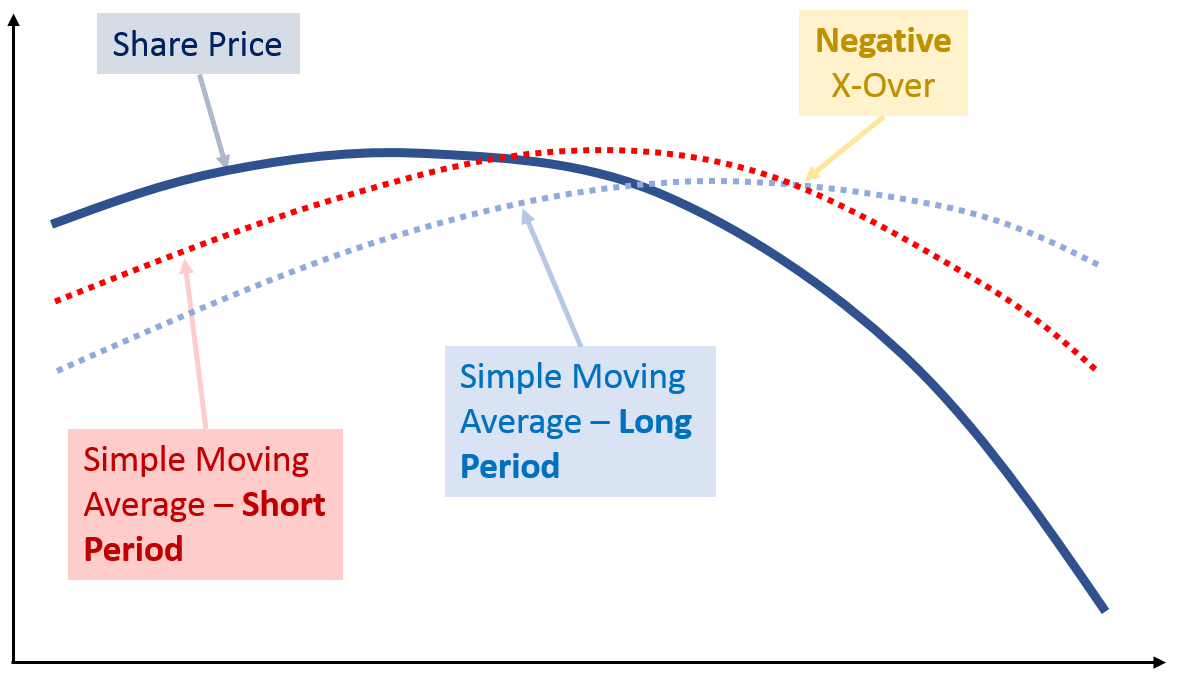

When a new downtrend starts, the same thing happens, but in the other direction. The share price is falling and the SMA curves are following that price move, but with delays.

When a negative x-over happens, the short period SMA curve that was previously above the long period curve is now diving below it, indicating that a new downtrend might be starting.

Let’s look at a real example.

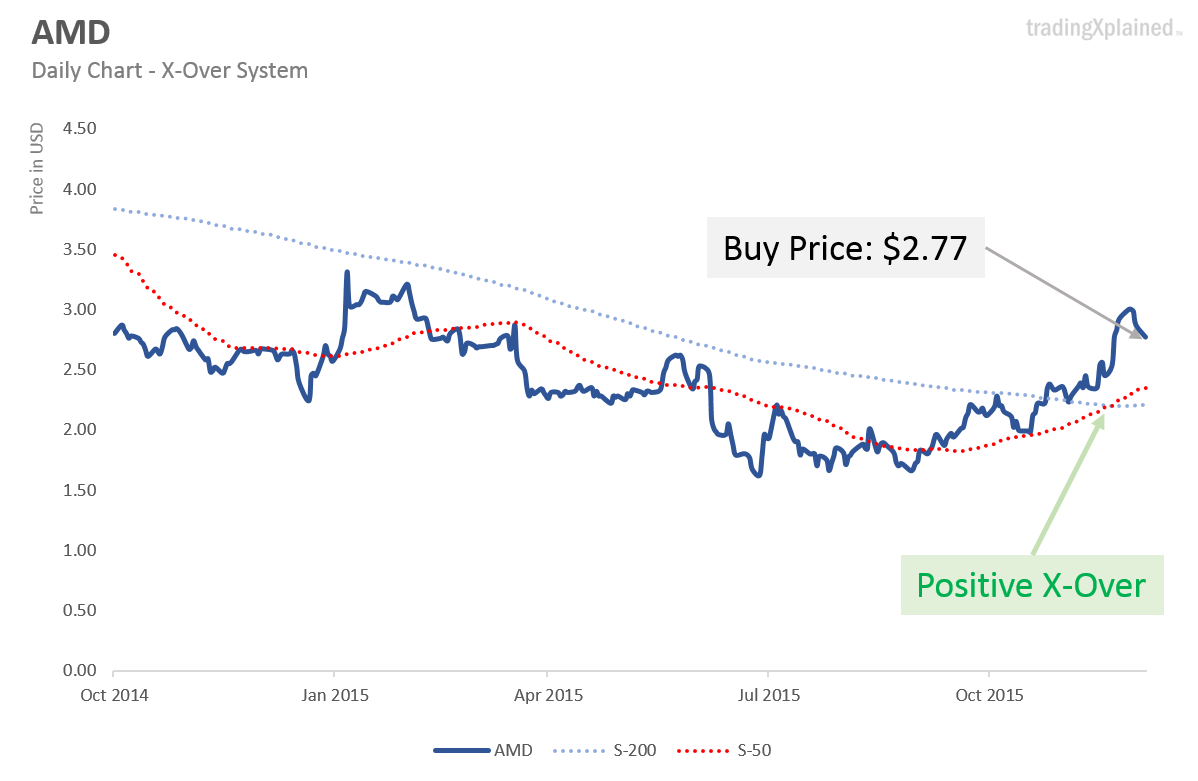

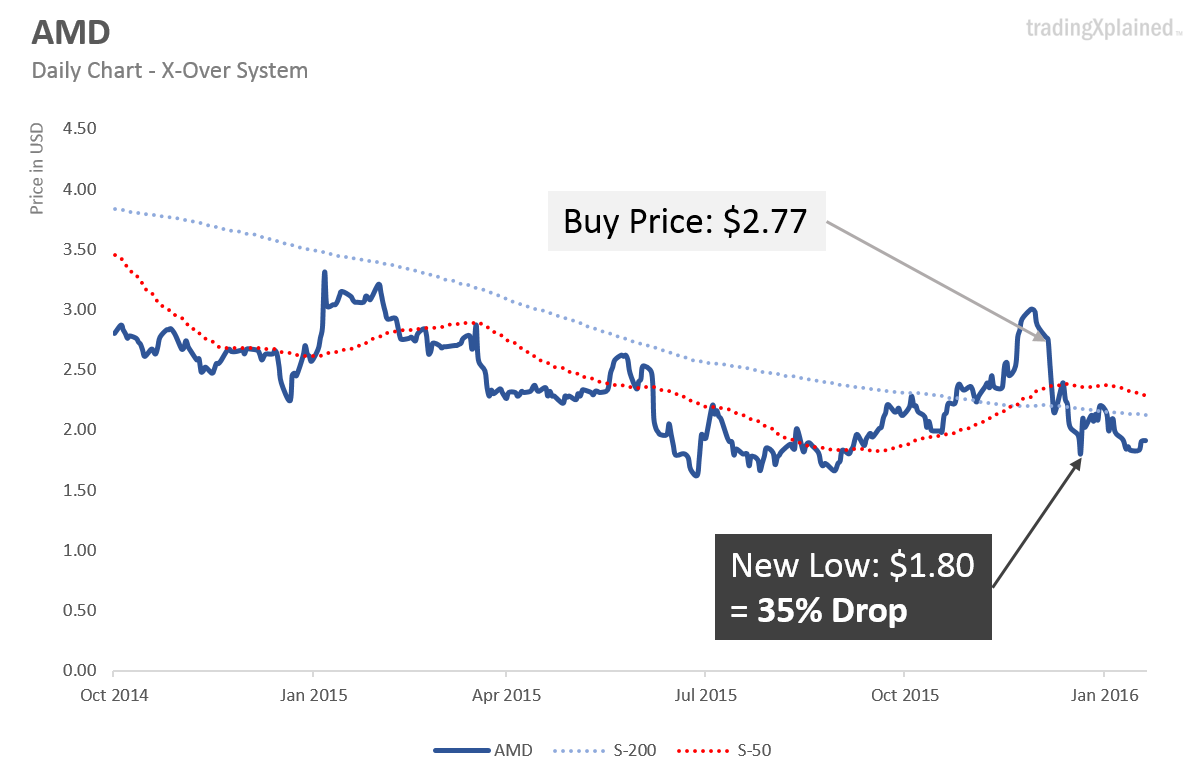

Below stock chart of AMD (the computer chip manufacturer) has been in a downtrend for more than a year.

It showed the occasional potential upwards price move, but it was never enough to create an X-Over signal.

Until December 2015!

The price has been moving upwards since September, but only in December is the uptrend strong enough to create a buy signal. The SMA-200 and SMA-50 curves are crossing over each other.

And let’s say we decide to buy after a week or so, at $2.77.

The lowest price was at $1.62 a few months back, so the trend should already be well on its way. We set a sensible stop price (discussed in Lesson 5 and 6) and lean back, wait for the trend to continue.

But then what happened? We got whipsawed!

The price drops again, by 35% below our purchase price.

Unless our stop price was set below $1.80, we would have been out of this trade at a loss. This is called a Whipsaw – the price made a sudden move against us.

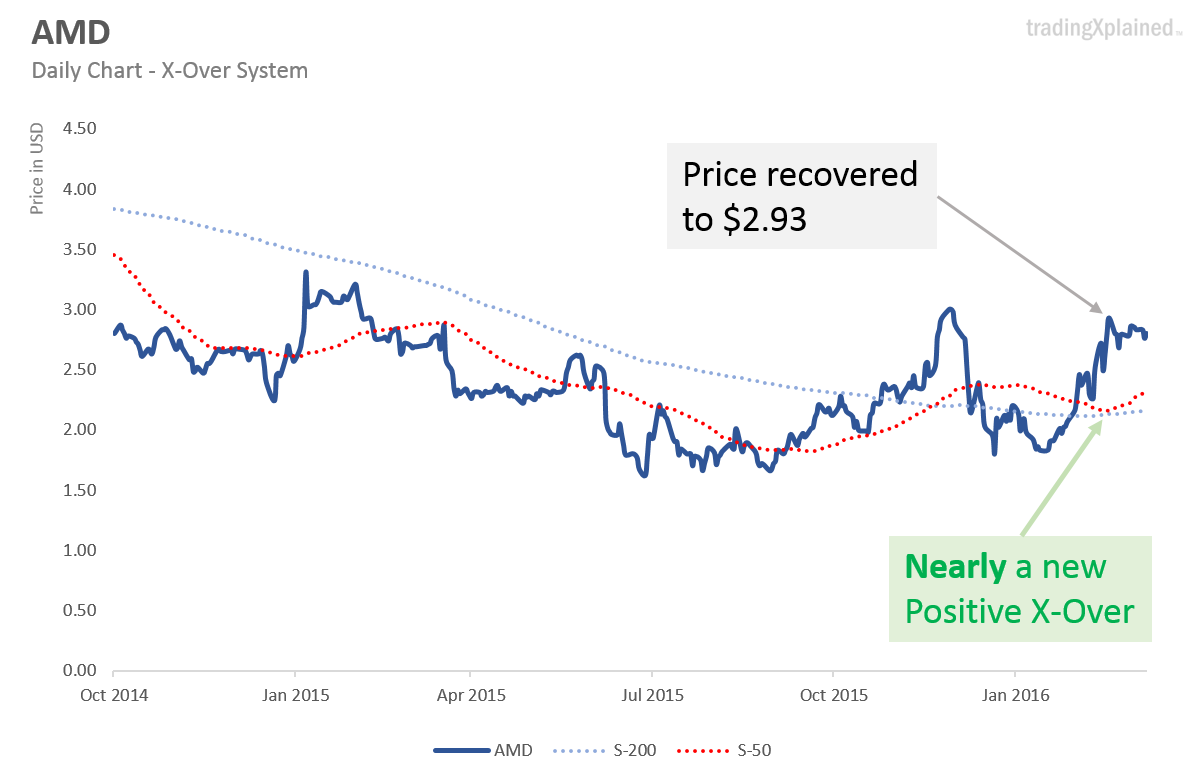

So, what about the uptrend?

Is it broken? Will the previous, long-term downtrend continue and this was just a fluke? The SMA-50 curve is on a dive again… but then…

Then prices recover and are back to new highs.

The SMA-50 reverses again, causing a near X-Over. It’s not the real thing… but it’s pretty close. Should we give it another try? Maybe the uptrend is not dead after all.

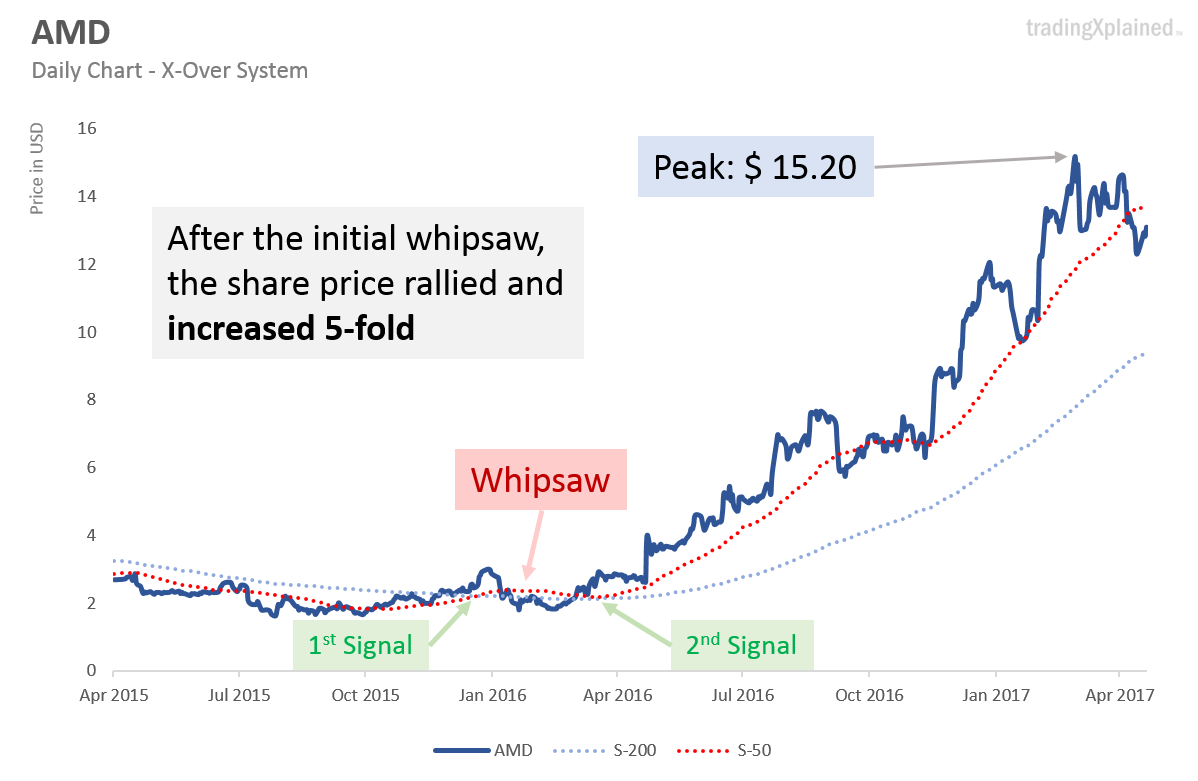

Long story short: we give it another shot and but at around $3.00, again setting a stop price. Look what happened.

Over the next 12 months, AMD share prices rallied into a serious, long-term uptrend, reaching 5 times its purchase price.

Imagine you had bought shares for $10,000… reaching $50,000 after a year.

That’d be pretty amazing!

At the same time, it shows what can happen after buy signals – they can come early and you might get kicked out of your trade before the actual trend happens.

Or the trend might never happen… and it was a false signal.

So, if there is another buy signal, or if the trend recovers, should you repeat the trade?

In general – YES.

You should, because you do not want to miss such an opportunity. Getting whipsawed is the cost of doing business when using a stock selection system.

Remember, it is more important to catch the big trends than to avoid a few more bad signals.

Building your own stock picking system

I showed you two stock picking systems in this lesson.

They are simple and they have worked well over the last several decades. There are many others – either variations of the ones I showed you, or systems that use other indicators to achieve the same thing.

How to build your own stock picking system? I suggest you reproduce the ones I already introduced to gain some practice using them. You can always adjust them later.

- First, set your objectives and preferences

- Second, find the tools you want to use to visualize charts and indicator curves

- Third, follow this lesson’s worksheet to build a stock picking system from scratch

And at last…

A word of advice concerning stock picking systems:

You might be tempted to look for the “perfect” stock picking system – the one that achieves better and more reliable buy signals, fewer whipsaws, etc.

And that’s not a bad thing. Just don’t spend all your time on it. The law of diminishing returns applies here, too!

I have spent a long time working on my stock selection systems; I optimized and tested a large variety of them, some worked a bit better, some a bit worse.

Overall I noticed that if I filter out too many potential whipsaw signals, then I lose too many big opportunities.

It’s like saving pennies but missing the Multi-Dollar income!

And I concluded that the simpler the system, the better its performance (not to speak about wasting time!) – in the long run!

There is no such thing as a perfect system.

There will always be situations where the market does not play by your rules – and the solution is not to building more and more complex stock picking systems, but instead to make the occasional adjustment and let your risk management system protect you over those stretches of bad trades.

What are you waiting for?

Get working on your stock picking system!

Download the worksheet and follow the instructions. If you are stuck, send me an e-mail or leave a question in the comments of this lesson.

Get Updates!

Subscribe for FREE

Browse by Topics

What to Invest In

Make the most out of investing by starting early.

Stock Trading 101

From Novice to Profitable Investor in 8 simple steps.

Reduce your Risks

Dramatically improve your trading performance with the Slash Formula.

Get the Lesson 4 download:

Click on the image or button below to get the 29-pages PDF file.

This lesson worksheet contains forms, explanations and details about:

- Setting objectives and preferences

- Tools to build your stock selection system

- Example 1: Building a Breakout System

- Example 2: Building a X-Over System

- System parameter review

- Trading Rule Updates

JOIN OUR FREE NEWSLETTER

Get the latest trading techniques right into your inbox.

0 Comments